- Solutions

- Global Financial Markets

- Cross-Currency Swap

Cross-Currency Swap

Hedge against currency and interest rate exposure

- Solutions

- Global Financial Markets

- Cross-Currency Swap

Cross-Currency Swap

Hedge against currency and interest rate exposure

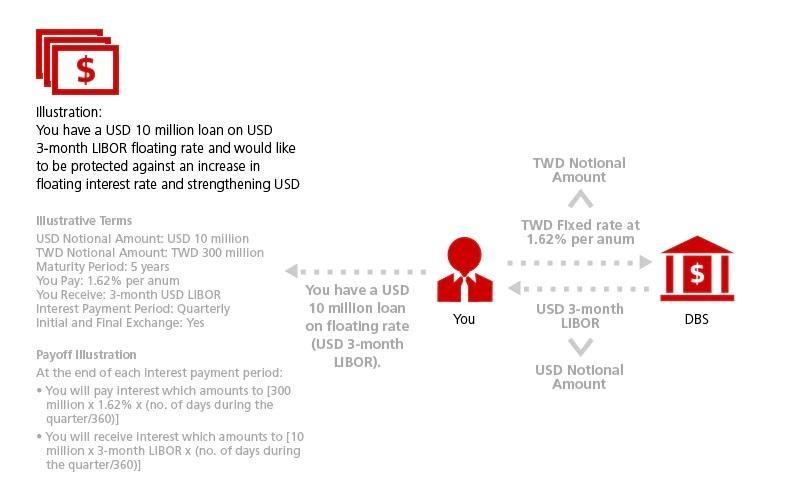

Hedge against both currency and interest rate exposures with our Cross-Currency Swap. This is an agreement between two parties to swap future interest payments, based on a principal amount in one currency for an equivalent amount in another currency. For example, you can choose to pay in a different currency on either a fixed or floating rate

Enjoy competitive pricing due to our market leader position and extensive network

Stay informed of the latest market developments with insights from more than 100 research analysts in Asia

Leverage the knowledge of our dedicated SME advisory sales team to identify and hedge against interest rate volatility

Conduct sophisticated cross-border transactions smoothly and efficiently with strategic advice from our regional advisory sales network

Please call us at +886 2 6606 0302 and we will arrange for a treasury specialist to speak with you

Call

+886 2 6606 0302

Operating hours: 8.30am to 6.30pm, Mon - Fri (excluding PH)