- Financing

- Working Capital

- Supply Chain Finance

Supply Chain Finance

Free up your working capital

- Financing

- Working Capital

- Supply Chain Finance

Supply Chain Finance

Free up your working capital

Programme based solution

Enabling a continual flow of liquidity access for both suppliers and buyers

Onboarding

Seamless onboarding process minimises hassle and reduces turnaround time

Paperless Processing

Automated processing reduces paper transactions

| Pre-shipment Supplier Finance | Post-Shipment Supplier Finance |

|---|---|

| As a supplier, you enjoy:

| As a supplier, you enjoy:

|

*You may also wish to just join the Post-Shipment Supplier Finance programme.

Supplier Finance for you as a Supplier

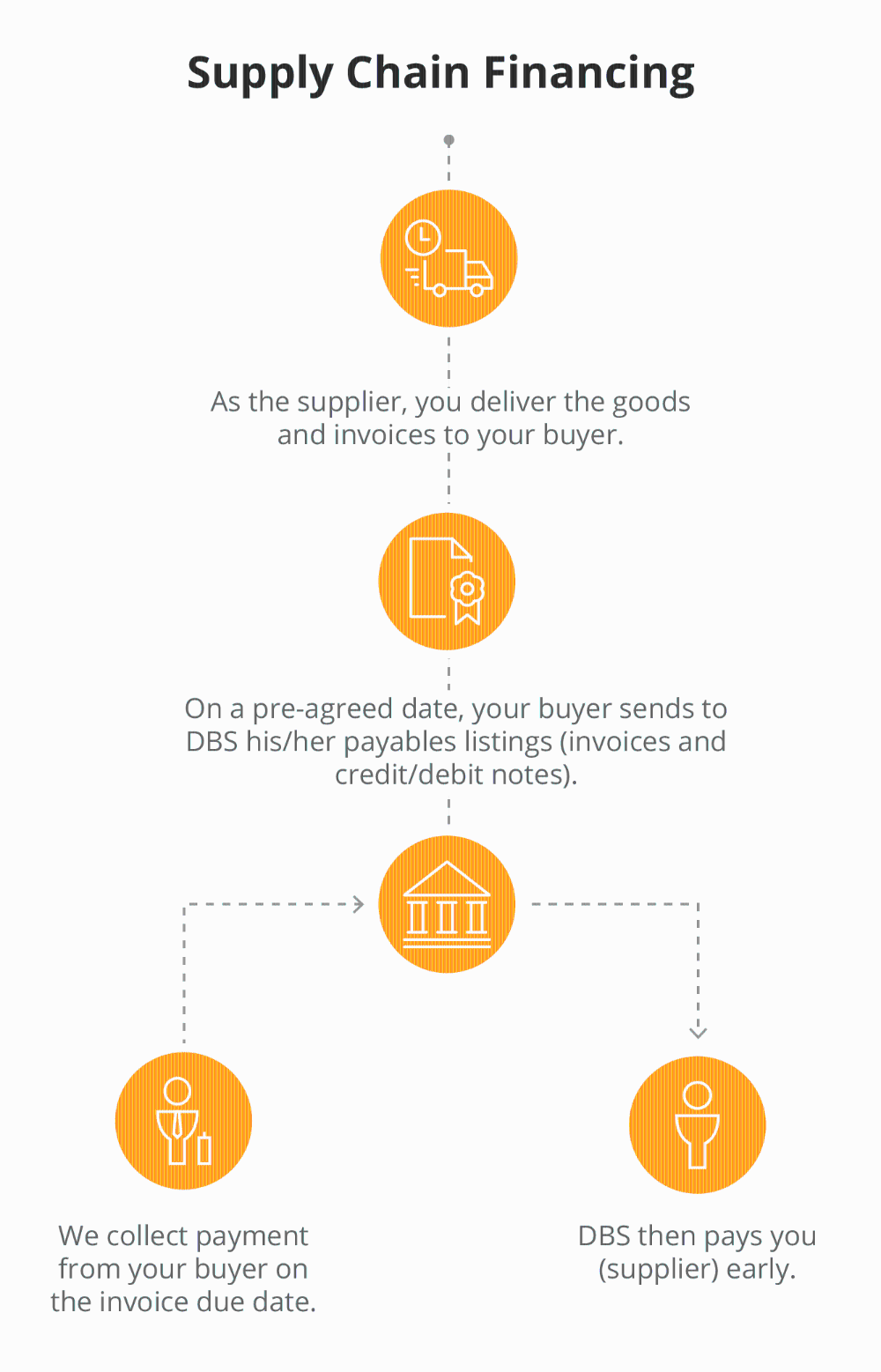

Through a Buyer-led Supplier Finance programme, DBS will provide an early payment to you based on confirmed invoices by your Buyer. Here’s how it works:

- As a supplier, you deliver the goods and invoice to your buyer.

- Your buyer sends us the invoice listing.

- We provide you with early payment.

- We collect payment from your buyer on the invoice due date.

SCF structures are led by a corporate client, known as an Anchor. As such, we approach Spokes (suppliers and distributors) only once we’ve negotiated an agreement with a suitable anchor. Please call us at +886 2 66060302 for more information or alternatively you may reach out to your Anchor for further discussions.

| What sales / purchases qualify for this financing? | |

| Trade transactions must be on open account terms and occur on a recurring basis. One-off sales or purchases do not qualify. |

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?