Related insights

- Indonesia markets: Domestic catalysts strengthen bearish pressure on rupiah 21 Jan 2026

- JPY Rates: Capitulation in the ultras? 21 Jan 2026

- Singapore Equity Picks21 Jan 2026

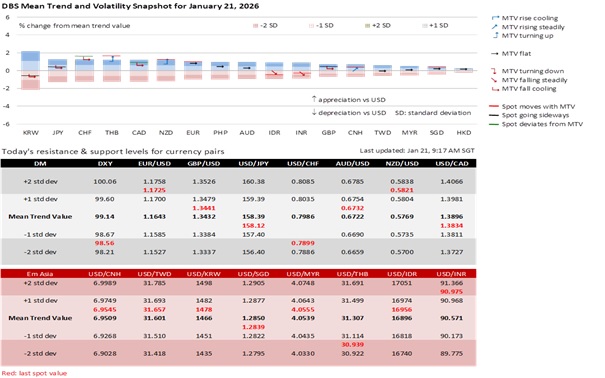

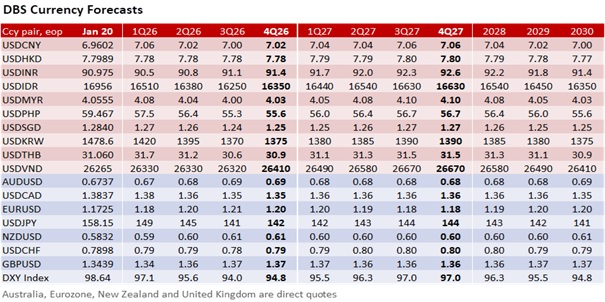

The “Sell America” trade returned as the dominant market theme this week. The S&P 500 Index plunged 2.1% to 6797, its worst day since October 2025. Investors feared that US President Donald Trump’s push to acquire Greenland, either militarily or financially, would spark a tariff war with Europe. Trump threatened to impose an additional 10% tariff on February 1, which will rise to 25% on June 1 on goods imported from Denmark, Finland, France, Germany, the Netherlands, Norway, Sweden, and the UK. US Treasury Secretary Scott Bessent rejected speculation that EU nations would respond to the tariff threat by dumping US bonds, following reports that Danish pension funds were exiting US Treasuries, which bolstered EUR/USD higher by 0.7% to 1.1725.

Hence, the US bond market was not spared from the sell-off in the JGB market, triggered by PM Sanae Takaichi’s call for a snap election on February 8. The US Treasury 10Y yield spiked by 7 bps to 4.293%, on top of last Friday’s 5.4 bps rise. The JGB 10Y yield surged 17 bps to 2.36% on Monday and Tuesday, more than the cumulative 15 bps increase in the first three weeks of this year. Japanese Finance Ministry Satsuki Katayama called for market calm, pushing back on the narrative that a stronger mandate for the Takaichi government would lead to unsustainable fiscal deficits and debt, following the announcement of a proposed two-year cut in the consumption tax on food.

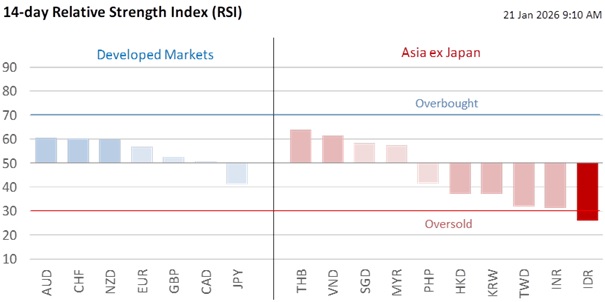

Against this backdrop, the greenback lost its haven appeal. The DXY Index depreciated 0.8% overnight to 98.56 overnight. Markets are alert to any announcements from the US and Japan, preferably a joint statement that uses coordinated language to address excessive volatility and disorderly one-sided market moves, a signal that Washington would not oppose Tokeyo’s stabilization efforts, including interventions in the JPY. Prime Minister Takaichi needs to stabilize both the JGB and JPY markets to prevent the united opposition from framing financial volatility as evidence of fiscal irresponsibility and policy loss of control. Markets do not rule out President Trump’s tendency to TACO (Trump Always Chickens Out) over Greenland, where past experiences have shown geopolitical escalation and tariff threats followed by partial walk backs. In the near term, do not expect a clean and sustainable trend but rather headline-driven volatility and a tendency towards range trading.

Quote of the Day

“Good advice is always certain to be ignored, but that's no reason not to give it.”

Agatha Christie

January 21 in history

British crime writer Agatha Christie published her first novel in 1921.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related insights

- Indonesia markets: Domestic catalysts strengthen bearish pressure on rupiah 21 Jan 2026

- JPY Rates: Capitulation in the ultras? 21 Jan 2026

- Singapore Equity Picks21 Jan 2026

Related insights

- Indonesia markets: Domestic catalysts strengthen bearish pressure on rupiah 21 Jan 2026

- JPY Rates: Capitulation in the ultras? 21 Jan 2026

- Singapore Equity Picks21 Jan 2026