Related insights

- Research Library06 Nov 2025

- USD Rates: Fiscal worries return 06 Nov 2025

- Fixed Income Weekly: Fiscal Worries Return06 Nov 2025

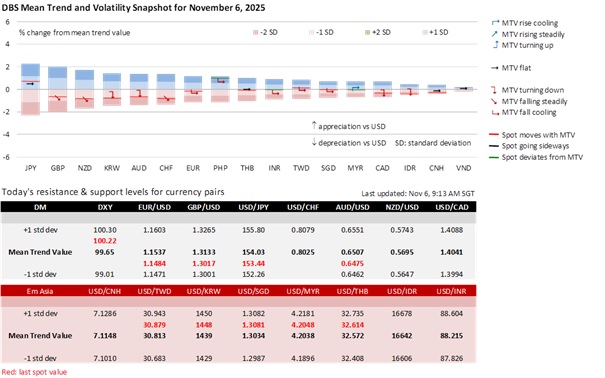

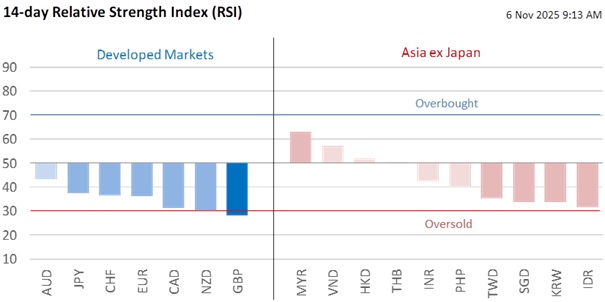

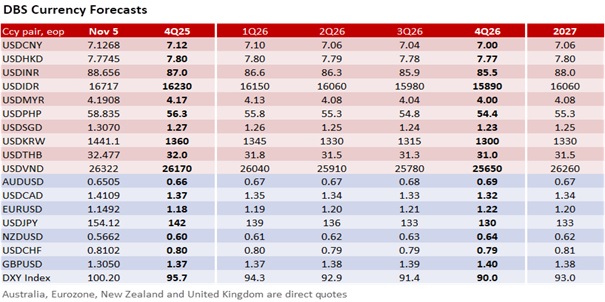

The DXY Index could not extend its rise above 100, reflecting ebbing US policy risk. Risk appetite improved overnight following the Supreme’s Court’s scepticism about Trump’s reciprocal tariffs and Republican setbacks in state elections, which may open the door to ending the US government shutdown. The Dow, S&P 500, and Nasdaq Composite indices rose by 0.5%, 0.4%, and 0.7%, respectively. EUR/USD may stabilize above 1.15 while GBP/USD held above 1.30 ahead of today’s Bank of England’s decision to keep the bank rate unchanged at 4%. Commodity and Asian currencies may find support from hopes of reduced protectionism and improving risk appetite.

The US Treasury 10Y bond yield rose 7.2 bps to 4.16% overnight, driven by the US Supreme Court’s scepticism that US President Donald Trump’s use of the tariffs under the International Emergency Economic Powers Act (IEEPA) was lawful. Justice Sonia Sotomayor noted that using emergency powers to raise tariff revenue appeared more like a budgetary tool than a national security measure, renewing market concerns that a ruling against Trump could remove a revenue source and deepen the fiscal deficit. The Court’s tone suggested a majority may be uncomfortable with giving the president unchecked authority under IEEPA, seeing it as a constitutional overreach. However, the Supreme Court only heard oral arguments yesterday, with a ruling only likely by the end of the year.

Hope has emerged that the US government shutdown, now officially the longest in history, may end as soon as next week, before Thanksgiving. The state elections in Virginia, New Jersey, and New York City handed the Democratic Party meaningful victories, placing more blame on the Republican Party for the political stalemate that led to furloughed federal workers, halted services, and economic drag. Despite the electoral wake-up call, the Senate still requires 60 votes for most funding bills, and neither party appears ready to yield. Democrats still want to secure healthcare subsidies, but Republicans insist on reopening the government first. The path to a finding a resolution remains bumpy.

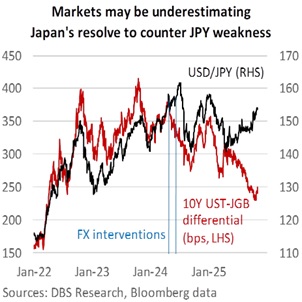

The JPY’s weakness around 154 per USD is drawing consistent verbal interventions. Vice Finance Minister Atsushi Mimura noted that the JPY’s depreciation was driven by speculation about Japan’s fiscal stimulus. Growth Strategy Minister Minoru Kiuchi confirmed that the Takaichi government has established a new panel to determine Japan’s growth strategy by next summer. Mimura noted that USD/JPY did not reflect the fundamentals indicated by interest rate differentials, countering market talk that the preconditions for an immediate intervention had not been met. During his visit to Japan last week, US Treasury Secretary Scott Bessent highlighted the importance of monetary policy in anchoring inflation expectations and preventing excessive exchange rate volatility. Bessent was also encouraged by Finance Minister Satsuki Katayama’s “deep understanding of how Abenomics has moved from a purely reflationary policy to a program that must balance growth and inflationary concerns for the citizens of Japan.”

Quote of the Day

“First they ignore you, then they laugh at you, then they fight you, then you win.”

Mahatma Gandhi

November 6 in history

In 1913, Mahatma Gandhi was arrested for leading an Indian miners' march in South Africa.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related insights

- Research Library06 Nov 2025

- USD Rates: Fiscal worries return 06 Nov 2025

- Fixed Income Weekly: Fiscal Worries Return06 Nov 2025

Related insights

- Research Library06 Nov 2025

- USD Rates: Fiscal worries return 06 Nov 2025

- Fixed Income Weekly: Fiscal Worries Return06 Nov 2025