Related insights

- Indonesia markets: Moody’s cuts outlook, affirms rating 06 Feb 2026

- Research Library06 Feb 2026

- USD Rates: Treasuries reprise haven role 06 Feb 2026

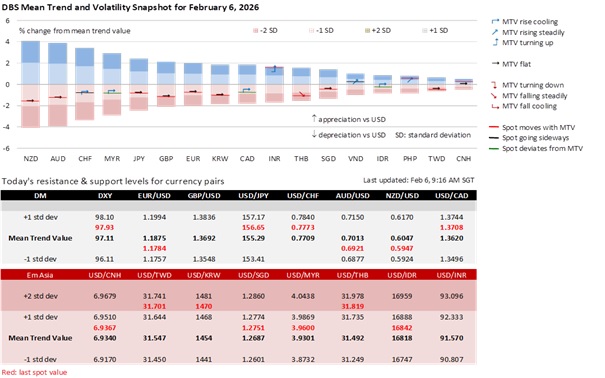

Following the European Central Bank meeting, EUR/USD may find support around 1.1746, the closing level in 2025. After depreciating 0.6% to 1.1777 in the first four days of this week, the FX pair is slightly below the 38.2% Fibonacci retracement level (1.1767) of the rally from 1.1573 to 1.2081 over January 19-27. Stepping back, EUR/USD’s uptrend has turned square-root, marked by a price channel currently between 1.16 and 1.2110, following its 13.8% surge in the first half of 2025.

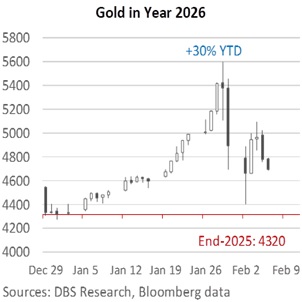

Although the USD debasement trade has eroded after gold plunged from its stellar high of USD5600/oz, gold found support just above its end-2025 level of 4320 and may consolidate around 4600-5000 during China’s long Lunar New Year holiday.

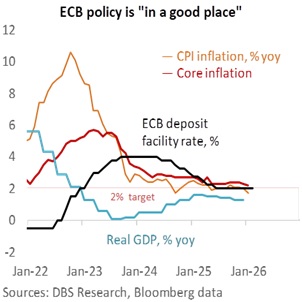

ECB President Christine Lagarde downplayed concerns about the EUR’s recent strength on inflation, reaffirming that inflation and monetary policy are “in a good place.” During her press conference, Lagarde urged reporters to take a broader, medium-term view, cautioning against reading the recent decline in headline inflation to below the 2% target as a simple and sufficient signal to resume rate cuts. With CPI inflation at 1.7% and core CPI at 2.2%, the ECB judged that inflation was consistent with its 2% target, reinforcing its view that price pressures have normalised even as it remains cautious about declaring victory prematurely. Lagarde continued to advocate a greater international role for the EUR, which she believed would increase the Euro Area’s resilience to external geopolitical shocks.

GBP/USD suffered a double whammy, tumbling by 0.8% to 1.3550 overnight. First, the market significantly increased bets, from 18.6% to 61%, that the Bank of England would cut the bank rate by 25 bps cut at the next March 19 meeting. Although the BOE left the bank rate unchanged at 3.75%, BOE Governor Andrew Bailey projected inflation to fall back to its 2% target earlier by spring, downgraded its 2026 GDP growth forecast to 0.9% from 1.2%, and saw the unemployment rate rising to 5.3% instead of peaking at 5.1%. Second, GBP’s political risk premium has increased significantly. Prime Minister Keir Starmer is facing a political crisis, triggered by the Mandelson case, escalating into calls within his Labour Party for a leadership change, and opposition parties pressing for a vote of confidence.

Following its 2.9% YTD surge to 1.3868 on January 27, GBP/USD has depreciated 2.4% to 1.3530 on February 5, with a possible support level around its end-2025 level of 1.3475.

Quote of the Day

"A good beginning makes a good end.”

Louis L'Amour

February 6 in history

Sir Stamford Raffles officially founded Singapore in 1819.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related insights

- Indonesia markets: Moody’s cuts outlook, affirms rating 06 Feb 2026

- Research Library06 Feb 2026

- USD Rates: Treasuries reprise haven role 06 Feb 2026

Related insights

- Indonesia markets: Moody’s cuts outlook, affirms rating 06 Feb 2026

- Research Library06 Feb 2026

- USD Rates: Treasuries reprise haven role 06 Feb 2026