Related insights

- USD Rates: Dicier sentiment as NFP awaited 19 Nov 2025

- Tencent Holdings Ltd19 Nov 2025

- Tianqi Lithium Corp19 Nov 2025

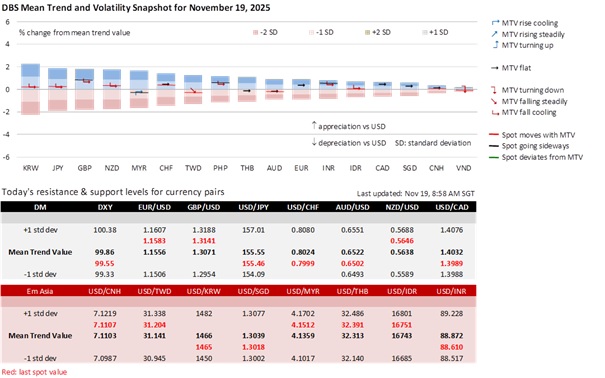

The DXY Index rose to 99.6 overnight after finding support at 99 last week. Despite the futures market lowering odds for a December Fed cut to less than 50%, the US Treasury 10Y yield eased for a second day to 4.11% after rising 7 bps to 4.15% in the first two weeks of November. Investors may be seeking safety from US tech stocks, which have remained weak on persistent worries about stretched AI overvaluations. The Nasdaq Composite Index fell 2% in the first days of this week, following the 0.5% and 3% declines in the previous two weeks. However, the DXY’s recovery is not assured amid fears of downside surprises in Thursday’s US nonfarm payrolls report. Resuming data releases after the government shutdown ended, the Department of Labour reported that initial jobless claims increased to 232k for the week ended October 18, up from 218k for the September 20 week. Consensus expects NFP to remain weak at 54k in September, increasing from 22k in August. With the DXY near the top of its 96.2-100.4 range, any disappointing labour data that renews Fed cut bets would increase the risk-reward skew towards a downside correction.

USD/JPY rose 0.2% to 155.5 overnight, its highest closing level since late January. The 10Y JGB yield rose further above 1.70% to 1.746%. Japan’s preliminary GDP contracted by an annualized 1.8% QoQ saar in 3Q25, supporting Finance Minister Satsuki Katayama’s proposed economic stimulus package of at least JPY 17 trillion (USD 110 billion). The OIS market lowered the probability of a rate hike by the Bank of Japan at its December 19 meeting to 27.4% from slightly above 50% earlier this month. However, BOJ Governor Kazuo Ueda signalled, during his meeting with Prime Minister Sanae Takaichi, that the central bank has yet to abandon its path to cautiously reduce the degree of monetary easing through rate hikes. While intervention risks have slowed its ascent, USD/JPY still needs a BOJ hike and a Fed cut in December to lower it.

AUD/USD is supported within this month’s range of 0.6460-0.6580. The Reserve Bank of Australia’s minutes cited modestly higher inflation for the decision to keep rates unchanged at the November 4 meeting. The futures market continues to price in a zero probability of a rate cut at the December 9 meeting and has little conviction in any cut in 2026. The Melbourne Institute reported that inflation increased again to 3.1% YoY in October, up from the 2.4% low in June, and above the 2-3% target. However, as a pro-cyclical and risk-sensitive currency, AUD is not immune to any US-led stock market sell-off that triggers an unwinding of carry trades.

Quote of the Day

“Four score and seven years ago our fathers brought forth on this continent, a new nation, conceived in Liberty, and dedicated to the proposition that all men are created equal.”

Abraham Lincoln

November 19 in history

In 1863, Abraham Lincoln delivered the Gettysburg Address, one of the most famous speeches in American history.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related insights

- USD Rates: Dicier sentiment as NFP awaited 19 Nov 2025

- Tencent Holdings Ltd19 Nov 2025

- Tianqi Lithium Corp19 Nov 2025

Related insights

- USD Rates: Dicier sentiment as NFP awaited 19 Nov 2025

- Tencent Holdings Ltd19 Nov 2025

- Tianqi Lithium Corp19 Nov 2025