Related insights

- Asia ex-Japan Equities13 Oct 2025

- Global Technology: What Renewed Trade Tensions Mean for Investors 13 Oct 2025

- Globalfoundries Inc13 Oct 2025

The week ahead is shaping up to be one of political brinksmanship across the major economies. In Washington, President Donald Trump’s standoff with the Democrats over the prolonged government shutdown risks turning into a wider confidence shock. At the same time, Trump’s threat to hit China with a 100% tariff on November 1 raised the stakes for trade negotiations ahead of the APEC Economic Leaders’ Summit in South Korea on October 31-November 1. In Tokyo, Sanae Takaichi’s path to becoming Japan’s first female prime minister is no longer assured after the Komeito ended its 26-year alliance with the Liberal Democratic Party. In Paris, President Emmanuel Macron has reappointed Sebastien Lecornu as prime minister, who will attempt to push through Budget 2026 again. With these four fronts in flux, investors should expect more uncertainty, headline volatility, and trading activities with little conviction in the week ahead.

The IMF-World Bank Annual Meeting in Washington, D.C. (October 13-18) is expected to be a non-event. Markets are already saturated with warnings about prolonged uncertainty. This year’s meetings will be more subdued because the Trump administration has distanced itself from multilateralism and globalisation. An increasing number of countries are resigned to the prospects of polarisation and policy fragmentation. The US Treasury’s effort to rescue Argentina is a clear case in point. Rather than channelling support through a broad IMF-led initiative, Washington has taken on a bilateral and politically driven approach, reflecting Trump’s preference for deal-making over multilateral coordination.

US-China trade tensions are sure to dominate discussions at the annual meetings. However, delegates will likely agree with IMF Managing Director Kristalina Georgieva that the global economy has weathered Trump’s tariffs better than expected, despite the earlier US-China tit-for-tat tariff exchanges that eventually gave way to two trade truces in May and August.

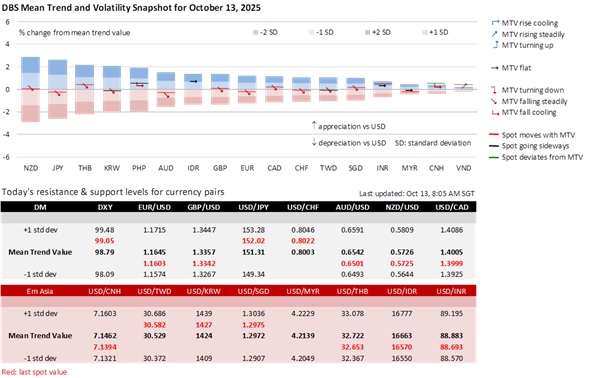

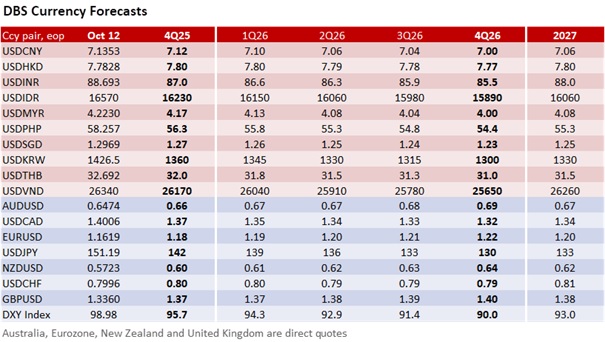

As before, Washington and Beijing are weaponizing their structural advantages. Trump is flexing the US’s leverage as the world’s largest buyer with 100% tariffs, while China leverages its control of supply chains, especially rare earths and critical minerals. Managed brinksmanship has become a strategy to force coercion, in Washington’s case, and to compel engagement, in Beijing’s case, to negotiate from a position of strength too, while leaving room to rollbacks to avoid a full-blown trade war. If so, this negotiating tactic may keep the door open for a possible Trump-Xi meeting at the APEC Summit, as a political win for Trump, and another milestone in Xi’s “Strategic Endurance” priority in the next 15th Five Year Plan (2026-2030). Before the escalation in trade tensions, the central bank (PBOC) appeared to be keeping the USD/CNY fixing stable within September’s 7.1008-7.1152 range into the Chinese Communist Party’s Fourth Plenum (October 20-23). Let’s see if the PBOC continues to do so.

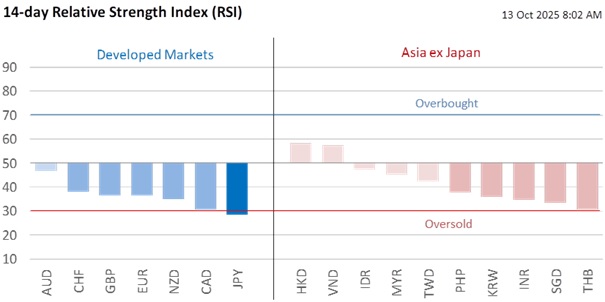

USD/JPY could decline below 150 again. USD/JPY has room to retrace the post-Takaichi victory surge from 147 further. Following Komeito’s departure from the LDP-led coalition, the Diet’s vote for Japan’s prime minister was delayed from October 15 to October 20, at the earliest. If Takaichi fails to form a new coalition with other parties, Japan could end up with her as a prime minister leading a minority government (more likely) or a non-LDP premier leading a united opposition coalition (less likely). In either scenario, the case for Takaichi’s Abenomics-style stimulus diminishes due to political fragmentation, which limits aggressive fiscal expansion or resistance to the Bank of Japan’s monetary policy normalization. The JPY could also reprise its haven status, as witnessed from last Friday’s response to the S&P 500’s 2.7% plunge to a four-week low driven by Trump’s threat to impose a 100% tariff on China.

We are turning cautious on EUR/USD after its five-week sell-off to 1.16. The euro’s decline from its 1.1920 peak started as a USD recovery story, driven by an unclear Fed cut outlook following the Fed’s 25-bps cut in mid-September. EUR/USD’s next fall below 1.17 was triggered by Sebastien Lecornu’s first resignation as French prime minister on October 6, just after 27 days of his appointment. However, President Emmanuel Macron reappointed Lecornu as prime minister on October 11 and formed a new government on October 12. This move aims to present Budget 2026 to the National Assembly this week, thereby meeting the mandatory 70-day negotiation period for lawmakers to debate and amend the bill before its approval by the end of 2025. The far-right and the far-left parties have been clear about voting down the new government. However, the second Lecornu government could survive another no-confidence vote if it gets the support of the Socialist Party in exchange for suspending Macron’s pensions reform.

Although the US will not be releasing its CPI inflation data on October 15, Fed Chair Jerome Powell will be speaking on the economic outlook and monetary policy at the NABE Annual Meeting. Following the US stock market’s plunge last Friday, focus will be on his remarks made at the Peterson Institute for International Economics on September 23, which stated that “equity prices were fairly highly valued” by many measures. Given the fragile investor sentiment, Powell will likely adopt a more cautious and balanced tone to avoid further unsettling markets and maintain financial stability.

Other Fed officials may also soften their rhetoric on tariff-driven inflation risks, aligning instead with New York Fed President John Williams’ risk-management approach, which supports more rate cuts to support the labour market, especially amid the prospect of a prolonged government shutdown. Also, Trump-appointed Fed Governor Stephen Miran will likely intensify calls for deeper rate cuts. Interestingly, the US Bureau of Labor Statistics will be bringing some furloughed employees back to release the CPI data on October 24, in time for the FOMC meeting on October 28-29.

On October 14, we expect the Monetary Authority of Singapore to slightly reduce the slope of its SGD NEER policy band. MAS Core inflation has declined below this year’s official forecast range of 0.5-1.5%, with CPI-All Items inflation at its range’s floor. We expect advance GDP growth to decelerate to 2% YoY in 3Q25 from 4.4% in 2Q25, at the floor of its medium-term potential growth rate of 2-3%. Non-oil domestic exports contracted in July-August after double-digit growth on frontloading, in line with policymakers’ expectations for a slowdown in the latter half of the year.

Quote of the Day

“In prosperity, our friends know us; in adversity, we know our friends.”

John Churton Collins

October 13 in history

The Whirlpool Galaxy was discovered by French astronomer Charles Messier in 1773.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related insights

- Asia ex-Japan Equities13 Oct 2025

- Global Technology: What Renewed Trade Tensions Mean for Investors 13 Oct 2025

- Globalfoundries Inc13 Oct 2025

Related insights

- Asia ex-Japan Equities13 Oct 2025

- Global Technology: What Renewed Trade Tensions Mean for Investors 13 Oct 2025

- Globalfoundries Inc13 Oct 2025