Related insights

- FX Tactical Ideas: Heightened Tariff Uncertainties30 May 2025

- CIO Industry Guide: May 202530 May 2025

- Global rates: Sustained inflows 30 May 2025

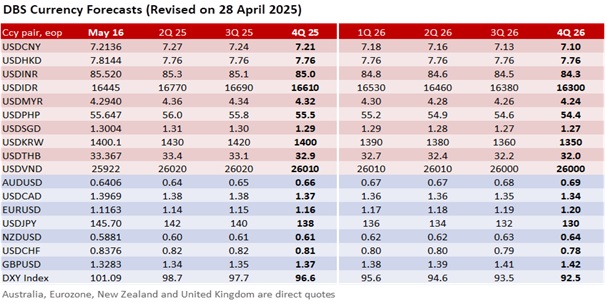

On May 20, a hawkish rate cut by the Reserve Bank of Australia could boost AUD/USD, which held above 0.64 for the third week. The RBA should lower the cash rate target a second time by 25 bps to 3.85% and signal a pause at the next meeting on July 8, mirroring the February 18 meeting. The data-dependent RBA will likely be more cautious than in previous meetings.

First, Australia’s GDP growth improved to 1.3% YoY sa in 4Q24 following four quarters of slowdown. However, RBA Governor Michele Bullock will likely emphasize a cautious approach to how Trump’s erratic trade policy impacts global growth and inflation, leaning towards the Fed’s wait-and-see stance. The US-China tariff reset on May 12 brought much-needed relief to investors and businesses, until the 90-day pause ends in August.

Second, the Melbourne Institute’s inflation gauge may be front-running CPI inflation, coming in surprisingly firmer at 3.3% YoY in April vs. 2.8% in March, above the RBA’s target of 2-3%. The wage price index increased to 3.4% YoY in 1Q25 from 3.2% in 4Q24, but mainly in the public sector instead of the private sector.

Third, Australia’s labour market remained tight, with the unemployment rate around 3.9-4.1% over the past year. Notably, the relative resilience of the Australian economy drove migration from New Zealanders seeking stable jobs and higher wages, away from NZ’s recession with a four-year high jobless rate.

After reviewing the developments following Trump’s “Liberation Day” tariffs on April 2, AUD/USD is unlikely to repeat the 10% sell-off in 2018-2019. In Trump 2.0, the administration is seeking to expedite the process towards trade deals with the “priority countries” such as Australia through its “escalate to de-escalate” tariff policy and tariff pauses. This helps to explain the AUD’s quick rebound on the tariff pauses after its initial capitulation to 0.59 on Liberation Day.

Unlike his predecessor – Scott Morrison during Trump 1.0 – Prime Minister Anthony Albanese did not align strongly with the Trump administration against China. Albanese has been working to mend the strained ties with Beijing since taking office in 2022. Following the Labour Party’s decisive re-election on May 3 and Albanese’s disappointment over Trump’s unjustified tariffs on US allies, the government has committed to defending national interests while seeking to diversify trade relations by elevating economic partnerships with the EU, India, and Southeast Asia. Unlike Trump 1.0, China did not devalue the CNY when US tariffs increased to 145% before the truce. The tariff reset underscored China’s strengthened position in tackling trade tensions against the US.

Following Moody’s decision to axe the US’s final AAA debt rating on May 16, AUD – which retained all three AAA debt ratings with stable outlooks – is looking like a sounder proposition than the greenback. In the two elections that elected their leaders for a second term, Australian voters endorsed the Labour Party’s centrist policies and stable leadership amid global uncertainties, contrasting with Trump’s disruptive and erratic trade and “America First” agenda.

Quote of the Day

“A great man is hard on himself. A small man is hard on others.”

Confucius

May 19 in history

In 1828, US President John Quincy Adams signs the Tariff of 1828/Tariff of Abominations into law to protect industry in the North.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related insights

- FX Tactical Ideas: Heightened Tariff Uncertainties30 May 2025

- CIO Industry Guide: May 202530 May 2025

- Global rates: Sustained inflows 30 May 2025

Related insights

- FX Tactical Ideas: Heightened Tariff Uncertainties30 May 2025

- CIO Industry Guide: May 202530 May 2025

- Global rates: Sustained inflows 30 May 2025