Related insights

- USD Rates: Beyond haven demand 08 Apr 2025

- Research Library08 Apr 2025

- CIO Insights 2Q25: Build Resilience Amid Tariffs08 Apr 2025

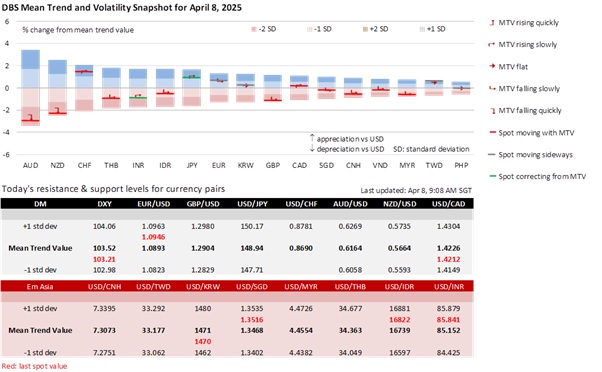

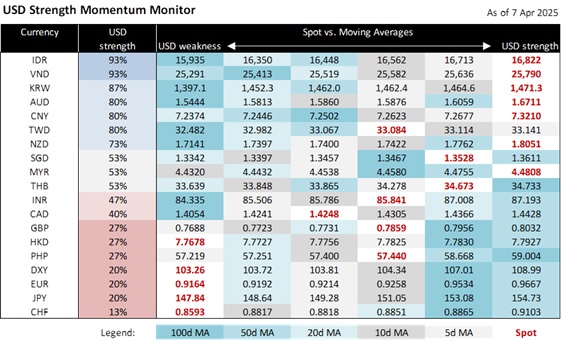

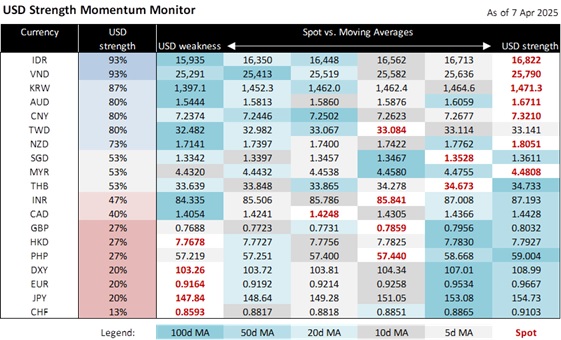

The DXY Index recovered a second day by 0.2% to 103.26. Within the DXY basket, the GBP depreciated most by 1.3%, followed by the JPY (-0.6%), EUR (-0.4%), and CAD (-0.2%). The USD’s downside has become limited because the factors – plunging equities and bond yields – that drove its weakness started to spill over globally, with the contagion effect killing the relative trade. Although the CHF bucked the overnight trend with a 0.2% gain, USD/CHF rebounded at every attempt in the past two sessions to break the pivotal support level of 0.85. When the Swiss 2Y bond yield was briefly negative, investors recalled the Swiss National Bank’s readiness to return to negative rates, if needed, and interventions to tackle the CHF’s haven status.

Additional support for the greenback came from the US Treasury 10Y yield, which rose for the first time in seven sessions by 18.9 bps to 4.184%. The Fed is pushing back against the market’s “recession” bet for 4-5 rate cuts this year. Fed Governor Adriana Kugler believed Trump’s tariffs had more pressing implications for inflation than economic growth, emphasizing the need to keep long-term inflation expectations anchored. Hence, markets will be wary of upside surprises in Thursday’s inflation report. Consensus expects CPI inflation to slow to 2.5% YoY (0.1% MoM) in March from 2.8% YoY (0.2% MoM) in February.

The S&P 500 Index slipped 0.3% on Monday, marking a notable slowdown in selling pressure following the sharp 10.5% decline over Thursday-Friday. Wall Street initially rallied on unfounded rumours of a tariff pause, duly denied by US President Donald Trump, who also threatened to hit China with an additional 50% import taxes if it did not rescind its retaliatory tariffs by April 8 or today. Following Trump’s reciprocal tariffs on April 3, the USD/CNY fixing has risen towards the top of its four-month range between 7.17 and 7.20, with spot USD/CNY above 7.30 and near the 1.5-year high of 7.3440.

However, attention is shifting toward potential trade negotiations which could provide some respite for currencies today. Trump has agreed to initiate trade talks with Japan following his phone conversation with Japanese Prime Minister Shigeru Ishiba. Trump’s decision to appoint US Treasury Secretary Scott Bessent, not US Trade Representative Jamieson Greer, to lead the talks suggests that the JPY’s valuation might become a significant topic in the discussions, apart from tariffs, non-tariff trade barriers and government subsidies. Trump has previously criticized Japan for a weak JPY to gain trade advantages that led to an “unfair” bilateral trade deficit. Expect the Japanese delegation to deny such allegations while emphasizing Japan’s contribution as the largest investor in the US in the past five years.

International trade negotiations with the Trump administration will be complex and challenging. For example, Vietnam offered to remove all tariffs on US imports and requested a 45-day delay in implementing Trump’s 46% tariff set to take effect on April 9. However, White House Trade Advisor Peter Navarro said the offer did not go far enough to address broader trade concerns about non-tariff barriers such as value-added taxes, trans-shipping Chinese goods through Vietnam, and intellectual property theft. Navarro’s stance indicated that the US was also seeking comprehensive agreements that addressed a wide range of trade practices beyond tariff reductions. Following Trump’s reciprocal tariffs announcements on April 3, USD/VND has risen from 25600 to an all-time high of 25800, where it has remained in the past three sessions.

Quote of the Day

“Let us never negotiate out of fear. But let us never fear to negotiate.”

John F. Kennedy

April 8 in history

Milk was sold in glass bottles for the first time in 1879.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related insights

- USD Rates: Beyond haven demand 08 Apr 2025

- Research Library08 Apr 2025

- CIO Insights 2Q25: Build Resilience Amid Tariffs08 Apr 2025

Related insights

- USD Rates: Beyond haven demand 08 Apr 2025

- Research Library08 Apr 2025

- CIO Insights 2Q25: Build Resilience Amid Tariffs08 Apr 2025