Related insights

- Moderna Inc 14 May 2025

- McDonald's Corp14 May 2025

- Asset Allocation: Portfolio Resilience in Era of Policy Ambiguity 14 May 2025

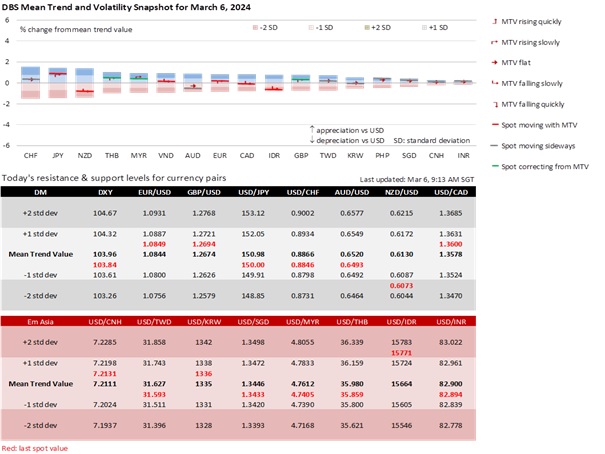

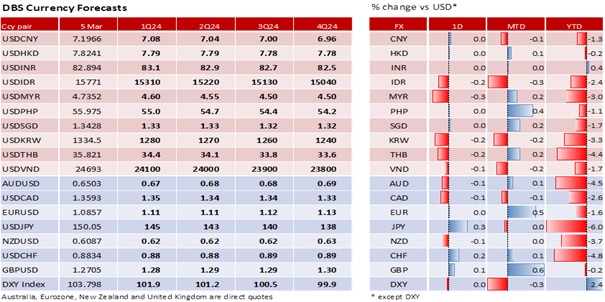

GBP faces two profit-taking risks after three days of appreciation. GBP/USD bounced off a trendline support at 1.26 last Friday and met trendline resistances around 1.2735-40 on Tuesday. First, UK Chancellor of the Exchequer Jeremy Hunt’s Spring Budget announcement will likely fall short of expectations. The expected personal tax cuts will unlikely be large enough to satisfy the Tory MPs’ hopes for a boost with voters or to the UK economy ahead of the next general elections due by January 2025. Given the need to finance the tax cuts with fiscal spending, the Office for Budget Responsibility will likely lower its 2024 GDP growth forecast from the 0.7% projected in November. The Bank of England correctly anticipated the technical recession but is not rushing to lower rates. For the BOE meeting on March 21, let’s see if BOE Governor Andrew Bailey remains comfortable with interest rate futures projecting the first cut in June or August. Bailey told the Treasury Select Committee that inflation on February 20, the BOE did not need inflation to hit the 2% target to cut rates. With CPI inflation falling at 3.9-4% for three months into January, let’s see if the BOE will stick by its earlier projection for CPI inflation to hit 2% in spring before rising again in the rest of 2024.

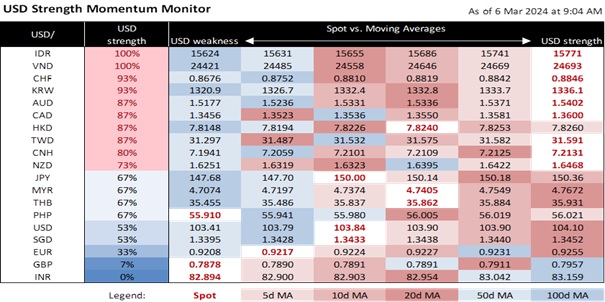

Second, Fed Chair Jerome Powell will confront and resist pressures from US lawmakers to cut interest rates at his semi-annual testimony on monetary policy before the House Financial Services Committee today and before the Senate Banking Committee tomorrow. At the FOMC meeting on January 31, Powell said a rate cut was not the base scenario at the March 20 meeting. Despite a letter from Senator Elizabeth and three Democratic lawmakers urging immediate action to relieve homeowners from high mortgage rates, Powell and Fed officials have been advocating patience on the resilience of the US economy and labour market. Atlanta Fed President Raphael Bostic, a voting FOMC member, favours delivering the first Fed cut in 3Q24, later than the futures’ projection for a June cut. The data-dependent market sees today’s ADP employment data increasing to 150k (consensus) in February from 107k in January, and Friday’s nonfarm payrolls holding at/above the 200k level. Next week, consensus expects CPI inflation to increase again to 0.4% MoM in February after rising to 0.3% in January from 0.2% in the previous month. Not surprisingly, DXY bounced off the floor of its two-week range between 103.6 and 104.2.

Quote of the day

"If people knew how hard I worked to get my mastery, it wouldn’t seem so wonderful at all.”

Michelangelo (born 6 March 1475)

6 March in history

Ghana becomes the first African country to gain independence from colonial rule in 1957.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related insights

- Moderna Inc 14 May 2025

- McDonald's Corp14 May 2025

- Asset Allocation: Portfolio Resilience in Era of Policy Ambiguity 14 May 2025

Related insights

- Moderna Inc 14 May 2025

- McDonald's Corp14 May 2025

- Asset Allocation: Portfolio Resilience in Era of Policy Ambiguity 14 May 2025