Related insights

- Japan: BOJ policy dilemma and market implications26 Jan 2026

- Delta Air Lines26 Jan 2026

- Exxon Mobil Corp26 Jan 2026

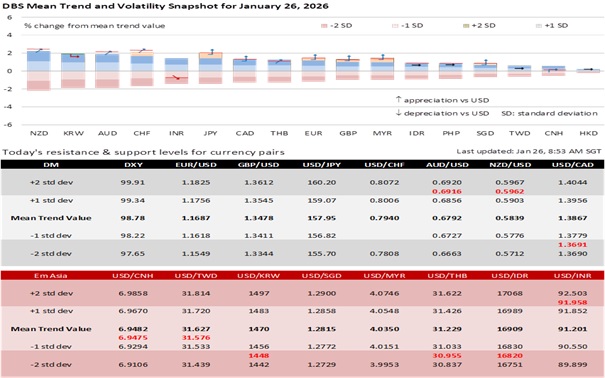

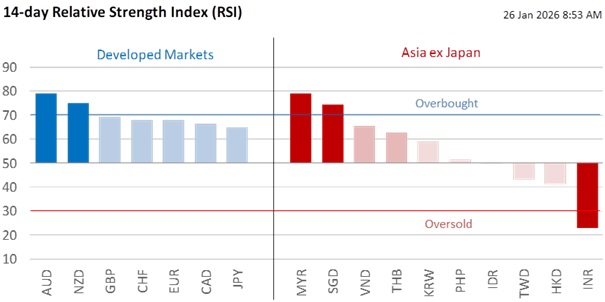

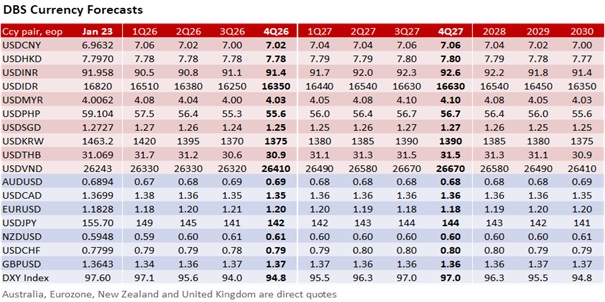

The USD suffered its worst weekly decline since May 2025 on two fronts. First, the DXY’s decline from 99.3 to 98.2 over January 19-20 was driven by US President Trump’s sudden TACO on threatened tariffs against the EU over Greenland. Second, the DXY’s plunge from 98.5 to 97.4 last Friday was a sharp USD/JPY pullback on suspected interventions, which spilled over into broader USD selling. The DXY Index plunged 1.8% to 97.6 last week, its lowest close since September. DXY needs to break a support level of 97.2 to extend its decline to the floor of the 96.2-100.5 range set since mid-2025.

We expect the Fed to pause at its January 27-28 FOMC meeting, following three consecutive rate cuts. After the last 25 bps cut to 3.75% on December 10, the US Treasury 10Y yield rose from 4.15% to 4.22%. The higher yield is considered USD-positive when interpreted as a stabilizing labour market and stronger-than-expected growth, reinforcing a gradual Fed cut cycle. However, the rise becomes USD-negative when driven by fiscal worries, echoing the debt dynamics that pushed JGB yields higher.

USD/CAD plunged 1.6% to 1.37 last week, near a significant trendline support around 1.3660. The Bank of Canada should keep the overnight lending rate unchanged at 2.25% (the low end of its estimated neutral range of 2.25-3.25%) at its January 28 meeting. According to the BOC Survey for 4Q25, 60% of firms expected CPI inflation of 2-3% over the next two years, suggesting wage growth has stabilized amid continued job cuts. US President Trump’s threat to impose a 100% tariff on Canada if it pursues a trade deal with China will likely raise the stakes ahead of the July review of the US-Mexico-Canada Agreement (USMCA).

We expect the Monetary Authority of Singapore to keep the three parameters – the slope, mid-point, and width – of the SGD NEER policy band unchanged at its policy review scheduled for January 29. Per our model, the SGD NEER was 0.25% below the band’s ceiling this morning, suggesting that USD/SGD’s downside is limited to 1.2675, barring further declines in the USD globally.

Markets are on high alert for Japanese action to arrest the JPY’s slide. USD/JPY plunged twice last Friday. The first decline, from 159.23 to 157.37, in late Asian trading was driven by suspected FX intervention by the Japanese authorities. The second decline from 158.23 to 155.63 in the US session was triggered by reports that the New York Fed conducted rate checks on USD/JPY. On Sunday, Prime Minister Sanae Takaichi said that her government will “take necessary steps against speculative or abnormal market moves” when asked about the weaknesses in the JGB market and the JPY in a talk show.

However, there has been no confirmation of actual intervention, which could limit downside follow-through in USD/JPY, unless it pushes decisively below December’s low of 154.35 and the 100-day moving average support level at 153.75. We are watching to see whether USD/JPY repeats USD/KRW’s recent experience. The sharp decline in USD/KRW from 1480 to 1430 during December 24-30 appeared consistent with suspected intervention. Without official confirmation, USD/KRW’s rebound to 1480 highs by mid-January highlighted the lack of follow-through, allowing broader USD strength and structural KRW constraints to reassert themselves.

Quote of the Day

“The single biggest problem in communication is the illusion that it has taken place.”

George Bernard Shaw

January 26 in history

In 1905, the world's largest diamond, the Cullinan, weighing 3,106.75 carats, was found near Pretoria in South Africa.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related insights

- Japan: BOJ policy dilemma and market implications26 Jan 2026

- Delta Air Lines26 Jan 2026

- Exxon Mobil Corp26 Jan 2026

Related insights

- Japan: BOJ policy dilemma and market implications26 Jan 2026

- Delta Air Lines26 Jan 2026

- Exxon Mobil Corp26 Jan 2026