- Thailand’s economic growth cycle has been largely synchronised with the advanced economies

- Goods trade remains linked with advanced economies’ prospects, notably US, despite China’s rise

- Thailand is more exposed to weaker US and European consumer demand than investment

- Thailand’s portfolio investment position is vulnerable to US financial market risk-off

- Net foreign direct investment inflows to face headwinds from global economic weakness

Related insights

- Short AUD-CHF on Geopolitical Concerns19 Apr 2024

- Central Banks Hold Steady19 Apr 2024

- AIA Group19 Apr 2024

Thailand’s economy is starting to recover after suffering from the COVID-19 pandemic for around two years. We expect the Thai economy, notably services, to benefit from a shift to endemic and the return of foreign tourists. Thai goods exports were the bright spot during the crisis, as they benefitted from the strong recovery in advanced economies, especially the US and Europe. However, this narrative is starting to shift negatively.

External headwinds are rising. There is a strong consensus that the US and the European economies are slowing, with rising recession fears. The slowdown is driven by a combination of aggressive Fed tightening to tackle high inflation in the US and the geopolitical conflict in Europe. Thailand, a relatively open economy, is likely to be hurt by the negative developments in advanced economies. For e.g., Thai goods export growth has moderated, even though it has remained above pre-pandemic trends. In this note, we explore Thailand’s direct exposures and possible spill-overs.

Trade channels are still exposed to advanced economies despite China’s rise

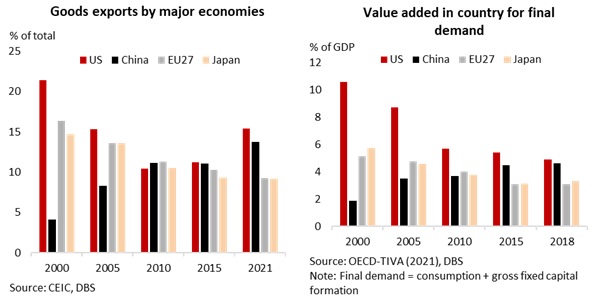

Thailand’s goods trade fortunes remain highly intertwined with advanced economies’ prospects, despite China’s rising influence. Thai goods exports to the US still accounted for ~15% of total overseas shipments in 2021, even though their share fell steadily from more than 20% in 2000. The rise of China’s export share, however, has been spectacular, as China evolved to become a key node within global and regional supply chains. China rose to similar levels as the US in 2021, from just below 5% in 2000. EU27 and Japan have steadily dropped in Thailand’s export composition, but still accounted for almost 10% each in 2021 vs close to 15% in 2000.

Our calculations using OECD-TIVA (2021) data show that the final demand exposures from these key export markets in terms of goods and services paint a similar trend as the goods export dynamics. US and China accounted for almost 5% of Thailand’s GDP each. EU27 and Japan were slightly lower at ~3% of GDP. In total, the US and EU27 accounted for ~8% of Thailand’s GDP.

Thailand is likely to be more impacted by weaker consumption demand in both the US and Europe than slowing investment activity. US consumption demand accounted for above 3% of Thailand’s GDP, slightly more than twice of investment demand. The sharp deterioration in US consumer sentiment amid the highest inflation in four decades does not bode well for Thailand. Thailand’s relative exposure to European consumption is even larger. Europe’s consumption accounted for 2.7% of Thailand’s GDP, almost 2.5x larger than investment.

Weakness through financial linkages

A slowdown in advanced economies’ growth can also impact Thailand through direct financial linkages. These would feed through from portfolio and foreign direct investment (FDI) exposures.

Regarding portfolio investment, Thailand recorded an overall net negative position in 2021, which has narrowed over the years. According to the IMF’s breakdown by economy, Thailand registered a net positive US portfolio investment position to the tune of ~1% of GDP in 2021, which was much higher than other major economies. This was possibly due to the combination of increasing US asset values (both equities and bonds) and rising Thai resident outward portfolio investments over the past few years. Heightened recession fears in the US, accompanied by US financial market risk-off and volatility, would weaken this support.

Topic

Explore more

E & S FocusThe information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related insights

- Short AUD-CHF on Geopolitical Concerns19 Apr 2024

- Central Banks Hold Steady19 Apr 2024

- AIA Group19 Apr 2024

Related insights

- Short AUD-CHF on Geopolitical Concerns19 Apr 2024

- Central Banks Hold Steady19 Apr 2024

- AIA Group19 Apr 2024