- The BOT signalled policy normalisation intentions in a hawkish hold during its June meeting

- Concerns on surging and above-target inflation come to the fore in BOT’s minutes

- Continued economic growth recovery as pandemic woes reverse amid a tourism comeback

- First 25bps hike in August meeting or earlier; gradual hikes with 1.25% as first milestone

Related insights

- Singapore Equity Picks16 Apr 2024

- Colgate-Palmolive Co16 Apr 2024

- Singtel16 Apr 2024

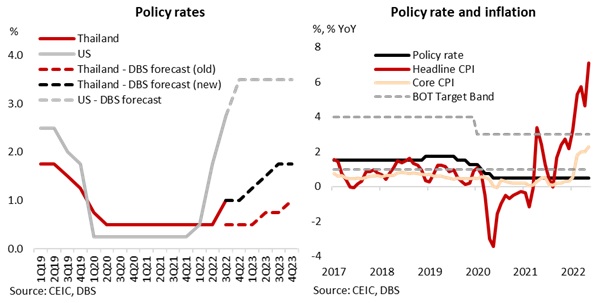

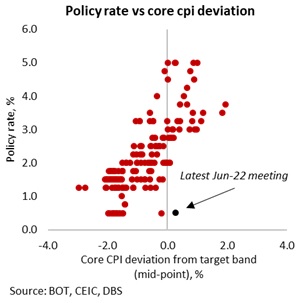

The Bank of Thailand (BOT)’s hawkish hold during its June meeting and communication that ‘a very accommodative monetary policy will be less needed going forward’ puts it on course to lift its policy rate in 2H22. This marks a significant shift from earlier expectations that Thai monetary policymakers would only normalise its loose policy in 2023. Upside inflation concerns and signs of an economic recovery that is gaining traction were key triggers for the hawkish pivot.

We are pulling forward our forecasts for the first BOT policy rate hike to 3Q22. With an urgency to tackle inflation, we expect the BOT to hike its policy rate from the record low of 0.5% in the August meeting (Thailand: Hawkish hold brings BOT closer to policy lift-off). While one of seven BOT’s rate setting panel said that there is no plan for an emergency meeting, an inter-meeting hike prior to August cannot be entirely ruled out: especially if June’s inflation surprise significantly again to the upside, and/or Thai baht weakness that is out of line with regional currencies driven by capital outflows concerns.

To avoid falling behind the curve on inflation, frontloaded back-to-back hikes appear likely. In a speech in June, BOT Governor Sethaput said that raising rates early will avoid future steeper hikes to combat inflation. The minutes to June’s meeting also mentioned greater future economic costs if policy normalisation is delayed. However, the BOT would be vigilant of not slamming the brakes on the growth recovery, and will seek a gradual approach. Returning to pre-pandemic 4Q19 policy rate of 1.25% as an initial milestone looks quite plausible by early-2023.

Inflation concerns reinforced in minutes

Inflation is emerging as a major concern for Thai monetary policymakers. Headline inflation has accelerated beyond the upper bound of the BOT’s 1-3% inflation target, has repeatedly surprised to the upside in 2022, while increases have broadened. The BOT raised its headline and core inflation forecasts for 2022 to 6.2% YoY and 2.2% YoY, respectively (from 4.9% and 2.0% previously) during the June meeting.

The Monetary Policy Committee (MPC) sees a significant increase in inflation risks, as reflected in the June policy statement and accompanying minutes. The risks come from uncertainties from global energy prices, possible broader and faster cost pass-through, and rising demand-pull pressures amid a recovering economy.

Our analysis in Thailand: Assessing rate hike risks showed that the BOT’s growth priority at a time of rising inflation represents a departure from its previous reaction function that emphasises core inflation. It is therefore a matter of time before the BOT becomes uncomfortable with accelerating inflation and start to prioritise price stability within its monetary policy framework beyond supporting sustainable economic growth. The BOT’s MPC also saw a need to build policy space and buffer to deal with potential future economic risks, beyond highlighting the shift in balance of risks towards rising inflation.

Growth recovery supported by pandemic reversal

The BOT’s dovish stance in 1H22 was driven by a downshift in growth expectations and concerns of a sustained fragile recovery. In the June meeting, the BOT shifted hawkish, as it appeared to be comforted by 1Q22 upside growth surprise and pandemic-related growth drivers. This was despite still lingering global growth headwinds and challenges.

The world is learning to live with COVID-19 and Thailand is also transiting to an endemic status. The reversal of pandemic woes is a tailwind for Thailand’s economic recovery. We expect Thai real growth to pick up to 3.5% in 2022 vs 1.6% in 2021.

Could high household debt limit monetary tightening?

Thailand, however, has one of the highest household debt-to-GDP ratio in the region, standing at 90.1% as of end-2021. Do Thai households have the capacity to deal with an interest rate shock from interest rate hikes? The BOT’s September 2018 monetary policy report showed that higher interest rates were expected to have a limited impact on households’ monthly debt repayment. The BOT assessed that non-instalment loans (individual borrowers bear higher monthly burden, if interest rate rises) only account for 34.3% of total household debt as of 1Q18. The rest were fixed rate loans and instalment loans (borrowers pay a fixed monthly payment with a flexible repayment period). Assuming a stable share since 1Q18 and recovering household incomes, Thai households should be able to deal with interest rate increases and would not pose a significant constraint to the BOT’s tightening path.

In the June 2022 meeting, the MPC assessed that rising inflation would have a larger impact on households than interest rate increases, as mentioned by BOT MPC secretary Piti Disyatat (Bangkok Post). The MPC found that high inflation would increase overall household expenses by around THB850/month (3.6% of total monthly income), vs THB120/month (0.5%) from a policy rate hike of 100bps. This suggests that choosing to delay interest rate hikes would be less favourable for overall Thai consumer fundamentals, weakening purchasing power and might dent still subdued consumer sentiment further.

To read the full report, click here to Download the PDF.

Subscribehereto receive our economics & macro strategy materials.

To unsubscribe, please clickhere.

Topic

Explore more

E & S FlashThe information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related insights

- Singapore Equity Picks16 Apr 2024

- Colgate-Palmolive Co16 Apr 2024

- Singtel16 Apr 2024

Related insights

- Singapore Equity Picks16 Apr 2024

- Colgate-Palmolive Co16 Apr 2024

- Singtel16 Apr 2024