- The RBI monetary policy committee voted unanimously to increase the policy repo rate

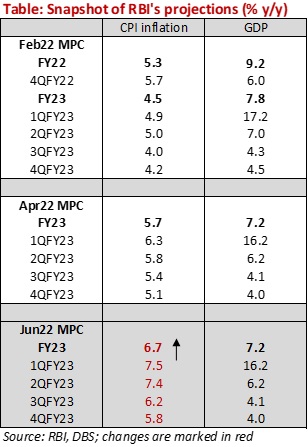

- Inflation forecast was revised up; growth forecast was constructive

- We note a subtle shift in the guidance

- Upside risks to inflation are broadening out and turning persistent

- The next hike, likely in August, would take the repo rate to pre-pandemic level of 5.15%.

Related insights

- Short AUD-CHF on Geopolitical Concerns19 Apr 2024

- Central Banks Hold Steady19 Apr 2024

- AIA Group19 Apr 2024

Decision

The Reserve Bank of India monetary policy committee (MPC) voted unanimously to increase the policy repo rate by 50bp to 4.9%, in line with our expectation. Consequently, the standing deposit facility (SDF) rate was adjusted to 4.65% and the marginal standing facility rate (MSF) and the Bank Rate to 5.15%. The Cash Reserve Ratio was left unchanged after a 50bp increase in the off-cycle hike in May.

Notably, the term ‘accommodative’ was dropped from the stance, as the MPC maintained that they ‘remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward’, implying that the stance has shifted to neutral-to-hawkish gear. We interpret this as a pitstop towards a clear shift to calibrated tightening stance, to ensure the stance is in sync with the hiking cycle.

Economic assessment

The policy commentary confirmed the primacy of price stability as a policy goal to prevent a hardening in adaptive inflationary expectations. FY23 CPI inflation was revised up by 100bp to 6.7% yoy, while GDP growth projection was left unchanged at 7.2%. A host of drivers were highlighted as risks to the inflation trajectory, including,

- a) geopolitics and elevated commodity prices.

- b) 75% of the increase in the inflation forecast was put on the food component. Whilst the wheat export ban was expected to soften domestic prices, a weak rabi harvest output was seen as a risk to cereal prices. A normal monsoon will be a positive, but adverse global supply conditions e.g., Indonesia’s action on edible oil are a concern.

- c) Excise duty cuts were encouraging but further rise in oil prices and revisions in energy prices could offset part of that relief. RBI’s current inflation forecast factors in oil at $105pb, above the $100bp built into the Monetary Policy Report published in April.

- d) Pipeline risks from RBI business surveys, from manufacturing, services, and infrastructure sector firms.

The tone on growth was more constructive as the FY23 growth forecast was maintained at 7.2%, seen benefiting from the likely normal south-west monsoon (and subsequent boost to farm output), rebound in contact-intensive services, improving capacity utilisation rates, government’s capex, and better trade performance. The external environment, especially spillover from prolonged geopolitical tensions, commodity prices, continued supply bottlenecks and tightening global financial conditions are seen as risks to the outlook. Our growth forecast is more conservative at 7.0%, with downside risks.

Outlook

The decision to remove ‘accommodative’ from the guidance implies a shift in the underlying policy bias towards a neutral-to-hawkish bent. Amidst signs that price risks are broadening out and turning persistent (we discuss details in the next section), frontloaded action will be key.

The central bank’s pivot, backed by the upward revision in the inflation forecast, lays the ground for further action, but at a calibrated pace. The next 25bp hike in August will return the repo rate to the first goalpost i.e., pre-pandemic pace of 5.15%. Thereafter, between Sep22 and Apr23, we expect a cumulative 100bp worth increase in increments of 25bps. The terminal policy rate is likely to stay data dependent, with our forecast is for the level to be above 6.25% by mid-2023.

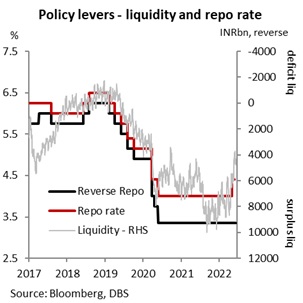

On liquidity, Governor Das recalled that that the introduction of the Standing Deposit Facility (SDF) as the floor of the liquidity adjustment facility (LAF) corridor at 3.75% earlier was effectively a 40bp hike vs the fixed rate reverse repo of 3.35%.

Add to this, the weighted average call money rate (WACR) i.e., the operating target of monetary policy had moved from an average of 3.32% to 4.07% during May 5-31. The RBI noted that that systemic liquidity had moderated, evidenced by the pullback in the average daily absorption under the liquidity adjustment facility (LAF) i.e., absorption under SDF and variable rate reverse repo (VRRR) of 14 days and 28 days at INR 5.5trn during May 4-May 31 vs INR 7.4trn during April 8-May 3, 2022.

In all, this moderation in surplus liquidity had likely lowered the need for a follow-up CRR hike. Towards bond yields, no specific measures were announced but an increase in spending obligations and supply-demand mismatch is likely keep yields buoyant, necessitating central bank’s support.

Inflation: generalised and persistent

Former US Fed Chairman William Martin said at one FOMC meeting "Inflation is a thief in the night and if we don't act promptly and decisively, we will always be behind." The RBI faces multiple and conflicting objectives at this juncture, including the need to rein in inflation, withdraw liquidity, support the currency, and stabilise bond yields. Amongst these, price stability which is the primary mandate of the central bank is likely to take precedence amongst signs that risks are becoming more generalised and persistent. We revise up our FY23 inflation forecast to 6.8% yoy vs 6.4% presently.

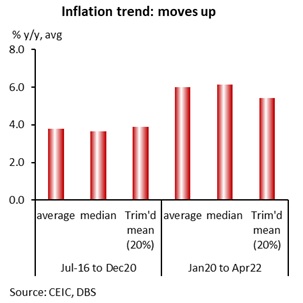

Firstly, average, median inflation and our trimmed mean measure – top 10% as well as top 20% - has moved up a gear between Jan20 and Apr22 compared to the time since the inflation targeting regime was adopted in the mid-2016 as shown in the chart.

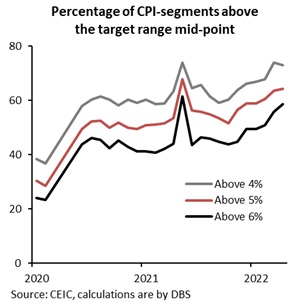

Secondly, the number of CPI inflation segments that are registering above 4%/5%/6% yoy increase i.e., higher end of the inflation target range have risen significantly. Compared to a quarter of the sub-components rising by above 6% pace in early 2020, ~60% are now above this mark at present, suggesting a broadening out in price pressures.

Thirdly, while goods inflation (buoyant commodities continues to pan out) has dominated the run-up in price pressures, the pass through in services is incomplete and thereby is likely to exert upward pressure over the next three-six months.

Finally, inflationary expectations are adaptive, and the central bank expects the government’s move to lower excise duties on fuel to have a salutary impact on these expectations. However, this could be offset by further rise in commodity prices or input prices, necessitating appropriate monetary policy measures, which in the current cycle would involve tapping the brakes on demand to rein in price pressures.

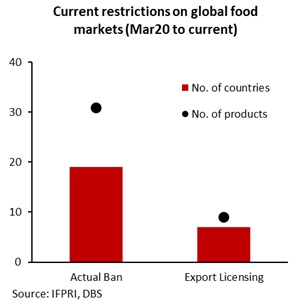

Globally, amidst inflationary concerns globally and food security assuming priority, several countries have taken measures to ensure sufficient domestic stockpiles to help contain prices, and lower hardship amongst the populace. Globally, since the Ukraine crisis, about 16.9% of the share of global trade impacted (by calories) has faced some extent of food export restrictions, higher than in wake of the pandemic as well as 2007-08 crisis. Since Mar20, about 19 countries have imposed an actual ban, whilst seven have imposed export licensing (see chart), according to data from International Food Policy Research Institute.

Given these risks and being a commodity price taker, the RBI MPC is likely to keep a close eye on the evolving inflation outlook and tighten policy reins in a calibrated fashion.

To read the full report, click here to Download the PDF.

Topic

Explore more

E & S FlashThe information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related insights

- Short AUD-CHF on Geopolitical Concerns19 Apr 2024

- Central Banks Hold Steady19 Apr 2024

- AIA Group19 Apr 2024

Related insights

- Short AUD-CHF on Geopolitical Concerns19 Apr 2024

- Central Banks Hold Steady19 Apr 2024

- AIA Group19 Apr 2024